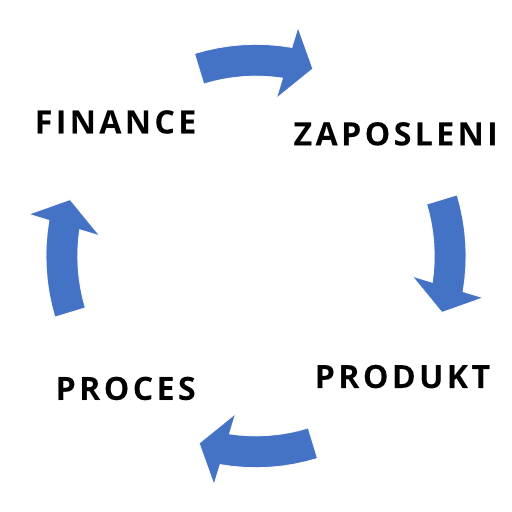

Companies primarily choose investments with the aim of generating higher EBITDA and value added per employee. However, sustainable financing takes into account ESG factors and objectives in addition to the economic objective.

What is sustainable finance?

Sustainable finance takes into account environmental, social and governance (ESG) factors. By introducing sustainable finance, you will be pursuing environmental, social and governance objectives.

Environmental factors: Sustainable corporate finance helps the environment by using responsible investments and project financing that promote environmental objectives (including the climate crisis, pollution and environmental degradation, and sustainable use of earth's resources), such as investments in renewable energy to further reduce climate change risks. Example:

- Company’s investments in energy cooperatives.

- Investments in BAT.

- Investments in green technologies.

- Investments in complete energy renovation of buildings.

- Investments in ISO 14001, LCA, EPD, ESG sustainability plans.

Social factors: Sustainable corporate finance also largely supports social factors. It helps increase trust and transparency between companies, customers and investors. It also helps improve the work environment for company's employees. It covers the protection of all civil, human and animal rights, diversity and consumer protection. Example:

- Investments in social enterprises.

- Profit sharing with employees.

- Investments in workplace health promotion.

- Investments in non-profit organisations (donations).

Governance factors: Sustainable financing helps companies promote better organisational habits and employee relations, reduce corruption and comply with fair and just labour laws. Example:

- Prudent decision making on procurements (obtaining 3 quotations and competitive dialogue with negotiations).

- Investments in digital management tools.

- Investments in training for company managers.

- Investments in motivational events, courses.

- v

Benefits of sustainable financing

Sustainable finance brings both short and long-term positive financial impacts to the company, while creating positive value for the society and staying within environmental restrictions. Companies not paying attention to the sustainability aspects of their business will be less resilient to the challenges of the future, which could jeopardise their existence. You should make medium- and long-term investments that will help create a more sustainable economy.

Sustainable finance sources: Banks in Slovenia support the green transition of the economy and provide financing in the areas of renewable energy, energy efficiency, clean transport, pollution prevention and control, sustainable water and wastewater management, green buildings, environmentally sustainable management of living natural resources and land use, and circular economy products, production, technology and processes, etc.

Environmental, social and governance factors (ESG factors) are part of their financing processes to encourage companies to act sustainably.

Our services:

- Consultancy on preparing a sustainability plan from the aspect of environmental factors.

- Consultancy on preparing a sustainability plan from the aspect of social factors.

- Consultancy on preparing a sustainability plan from the aspect of governance factors.

- Assistance in the preparation of a comprehensive sustainable financing plan.

- Assessment of investment project’s viability.

- Consultancy on obtaining debt funding.

Are you ready to make a change and reduce your company's environmental impact?

We have the experience and expertise to help you achieve impact on all three pillars of sustainability.